Mobile:+86-311-808-126-83

Email:info@ydcastings.com

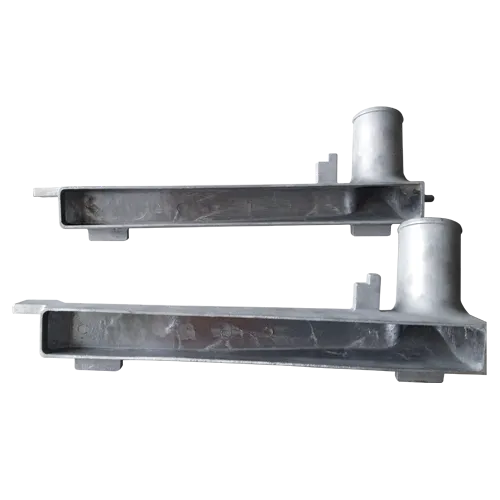

6 end cap

Understanding the 6% End Cap A Key Metric in Real Estate Investment

In the landscape of real estate investment, numerous metrics help investors assess the profitability and potential of properties. One such metric is the end cap, specifically the 6% end cap, which serves as a vital indicator for both institutional and individual investors seeking to understand the value of a property relative to its income-generating capabilities.

What is an End Cap Rate?

The capitalization rate, or cap rate, is a real estate valuation measure used to compare different investment properties. It represents the expected rate of return on an investment property based on the income that the property generates. The formula to calculate the cap rate is as follows

\[ \text{Cap Rate} = \frac{\text{Net Operating Income (NOI)}}{\text{Current Market Value}} \]

The net operating income is calculated by taking the total income from the property and subtracting the operating expenses (excluding mortgage payments) related to the property. A 6% cap rate implies that the property would generate a net operating income equal to 6% of its value annually.

Why 6%?

The significance of the 6% cap rate can vary based on the geographic location and the type of property in question. However, it is often seen as a benchmark in the real estate market for moderate risk. A property with a 6% cap rate is typically considered a stable investment, reflecting a good balance between risk and return.

6 end cap

In metropolitan areas or highly sought-after locations where property values are high, investors might be willing to accept lower cap rates—sometimes below 5%—because of the lower perceived risk and higher demand. Conversely, properties in less desirable areas or those that may require significant renovations might yield higher cap rates, often exceeding 7% or 8%, reflecting higher risk and potential vacancies.

The Implications of a 6% End Cap

1. Investment Strategy Investors using the 6% end cap as a target can strategize their acquisitions. It acts as a guideline to gauge whether a property is practically priced according to the income it generates. If an investment property shows lower cap rates, it may indicate that the property is overvalued or that the area might be experiencing declining demand.

2. Leverage and Financing Understanding the cap rate is essential when leveraging debt for property investment. Lenders will often evaluate properties based on their cap rate to ascertain risk. A 6% cap rate can reassure lenders of the income-generating potential of the investment, making financing prospects more favorable.

3. Market Analysis The 6% end cap can also serve a broader analytical purpose, offering insights into market trends. By comparing the average cap rates across different geographic markets, investors can identify emerging opportunities or potential threats. A consistent rise in cap rates across a market might indicate decreasing demand or oversupply, prompting investors to reconsider their positions.

4. Valuation Tool Investors frequently use the 6% end cap for property valuation. By analyzing a property’s NOI and applying the cap rate, investors can estimate the property’s fair market value. For example, if a property generates an NOI of $60,000, applying a 6% cap rate would suggest a market value of $1,000,000 ($60,000 / 0.06).

Conclusion

The 6% end cap serves as a crucial benchmark in real estate investment, providing insights into the income potential and valuation of properties. By understanding its implications on investment strategy, financing, market analysis, and property valuation, investors can make more informed decisions. As with any investment metric, the end cap should not be used in isolation but rather in conjunction with other indicators and thorough market research to create a comprehensive understanding of the property and its potential returns. In a constantly shifting real estate market, being adept at evaluating such key metrics is invaluable for success.

-

Why Should You Invest in Superior Pump Castings for Your Equipment?NewsJun.09,2025

-

Unlock Performance Potential with Stainless Impellers and Aluminum End CapsNewsJun.09,2025

-

Revolutionize Your Machinery with Superior Cast Iron and Aluminum ComponentsNewsJun.09,2025

-

Revolutionize Fluid Dynamics with Premium Pump ComponentsNewsJun.09,2025

-

Optimizing Industrial Systems with Essential Valve ComponentsNewsJun.09,2025

-

Elevate Grid Efficiency with High-Precision Power CastingsNewsJun.09,2025