Mobile:+86-311-808-126-83

Email:info@ydcastings.com

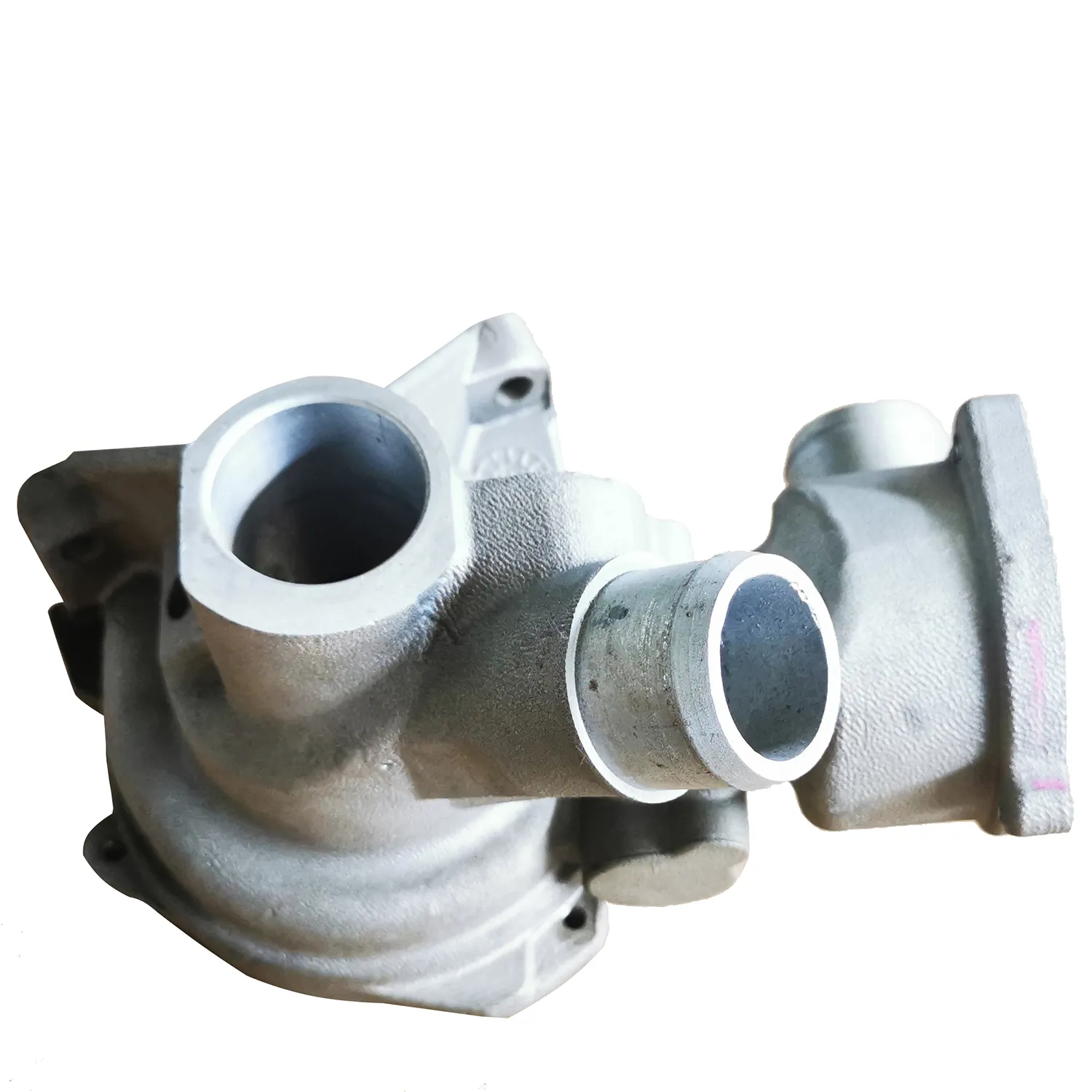

6.0 turbo housing

Understanding the 6.0% Turbo Housing Advantage

In recent years, the housing market has undergone significant transformations, driven by various economic factors, demographic shifts, and innovative financing options. One such innovation is the 6.0% Turbo Housing initiative, a concept gaining traction among both homebuyers and real estate investors. This article delves into the intricacies of 6.0% Turbo Housing, examining its benefits, mechanics, and the impact it may have on the housing landscape.

What is 6.0% Turbo Housing?

The term 6.0% Turbo Housing typically refers to a specific financing scheme designed to make homeownership more accessible and attractive for buyers. This concept revolves around a fixed interest rate of 6.0%—a figure that is aimed at maintaining affordability in a fluctuating market. The “Turbo” aspect signifies the acceleration of housing transactions, making it easier for prospective homeowners to enter the market quickly and efficiently.

Key Features of 6

.0% Turbo Housing1. Fixed Interest Rate One of the standout features of the 6.0% Turbo Housing program is its fixed interest rate. In an environment where interest rates can be unpredictable, having a stable rate allows homebuyers to plan their finances better. This predictability is crucial for budgeting, as it minimizes the risk of rising payments over time.

2. Terms of Financing The terms of financing under this program are often designed to be flexible. Homebuyers may find that they can choose from a variety of loan durations, such as 15 or 30 years, according to their financial plans and long-term goals. Some lenders may offer additional benefits for early repayments, further enhancing the attractiveness of this scheme.

3. Turbo Approval Process The Turbo in the name also reflects the expedited approval process associated with this housing initiative. Traditional mortgage applications can be lengthy and cumbersome; however, with Turbo Housing, streamlined application processes and technology integration allow potential buyers to receive approval in a fraction of the time. This rapid response can be crucial in competitive housing markets, where timing often dictates the viability of a purchase.

4. Inclusion of Additional Incentives Many 6.0% Turbo Housing initiatives come with added incentives, such as down payment assistance or grants for first-time homebuyers. These incentives can significantly lower the initial financial burden, making it easier for individuals to step onto the property ladder.

6.0 turbo housing

Benefits of 6.0% Turbo Housing

1. Affordability With a fixed 6.0% interest rate, buyers can lock in a lower monthly payment, especially when market rates are on the rise. This affordability helps a broader range of buyers—particularly first-time homeowners—access the housing market.

2. Market Stability The predictability of a fixed interest rate can contribute to overall market stability. Homeowners are less likely to default on their loans when they have a clear understanding of their financial obligations, thus buoying the market even amidst economic uncertainty.

3. Enhanced Homeownership Rates By making home loans more accessible and affordable, the 6.0% Turbo Housing initiative could potentially boost homeownership rates. This shift not only benefits individuals and families but also stimulates local economies, as homeownership often leads to increased spending in the community.

Challenges and Considerations

Despite its many advantages, prospective buyers should exercise caution before jumping into any housing initiative, including the 6.0% Turbo Housing program. Here are some considerations

- Market Variability Economic fluctuations can affect housing markets significantly. Buyers must remain aware of local market conditions and should consult financial advisors to ensure they make informed decisions. - Long-Term Financial Planning While the 6.0% fixed rate appears attractive now, buyers should consider their long-term financial health, including future income changes and potential market shifts.

Conclusion

The 6.0% Turbo Housing initiative presents an exciting option for homebuyers seeking stability and affordability in their housing investments. With its fixed interest rates, accelerated approval processes, and additional incentives, this program aims to democratize homeownership in a complex market landscape. As with any financial decision, thorough research and preparedness are essential for buyers looking to take advantage of this innovative housing strategy. By understanding the mechanics and benefits of the 6.0% Turbo Housing initiative, prospective homeowners can navigate the market with confidence and security.

-

Why Should You Invest in Superior Pump Castings for Your Equipment?NewsJun.09,2025

-

Unlock Performance Potential with Stainless Impellers and Aluminum End CapsNewsJun.09,2025

-

Revolutionize Your Machinery with Superior Cast Iron and Aluminum ComponentsNewsJun.09,2025

-

Revolutionize Fluid Dynamics with Premium Pump ComponentsNewsJun.09,2025

-

Optimizing Industrial Systems with Essential Valve ComponentsNewsJun.09,2025

-

Elevate Grid Efficiency with High-Precision Power CastingsNewsJun.09,2025