Mobile:+86-311-808-126-83

Email:info@ydcastings.com

French

Premium Steel Trading & Stainless Steel Precision Casting Parts Manufacturer

- Introduction to Steel Trading: Market Scope and Relevance

- Steel Precision Casting Parts: Defining Quality and Reliability

- Key Technical Advantages in Today’s Steel Trading Industry

- Comparing Leading Stainless Steel Investment Casting Companies

- Customized Solutions: Meeting Diverse Industry Needs

- Application Cases: Real-World Success Stories and Data Insights

- Future Trends in Steel Trading: Challenges and Opportunities

(steel trading)

Introduction to Steel Trading: A Vital Industry in Modern Manufacturing

Steel trading stands as a cornerstone within global manufacturing. The industry moves over 1.9 billion tonnes of steel annually, valued above $1.2 trillion (World Steel Association, 2023). This foundational raw material impacts sectors such as automotive, construction, energy, and precision engineering. Market volatility, stringent quality requirements, and evolving international regulations underscore the critical role of efficient steel trading

mechanisms.

The increasing demand for high-performance alloys and stricter sustainability goals push both traders and end-users towards embracing advanced solutions. Whether sourcing raw billets, finished products, or intricate parts, the steel market demonstrates resilience and adaptability, paving the way for innovative business models and partnerships. Understanding how steel precision casting parts and stainless steel investment casting companies integrate within the broader scope of steel trading provides manufacturers with an edge in cost efficiency and product reliability.

Steel Precision Casting Parts: Defining Quality and Reliability

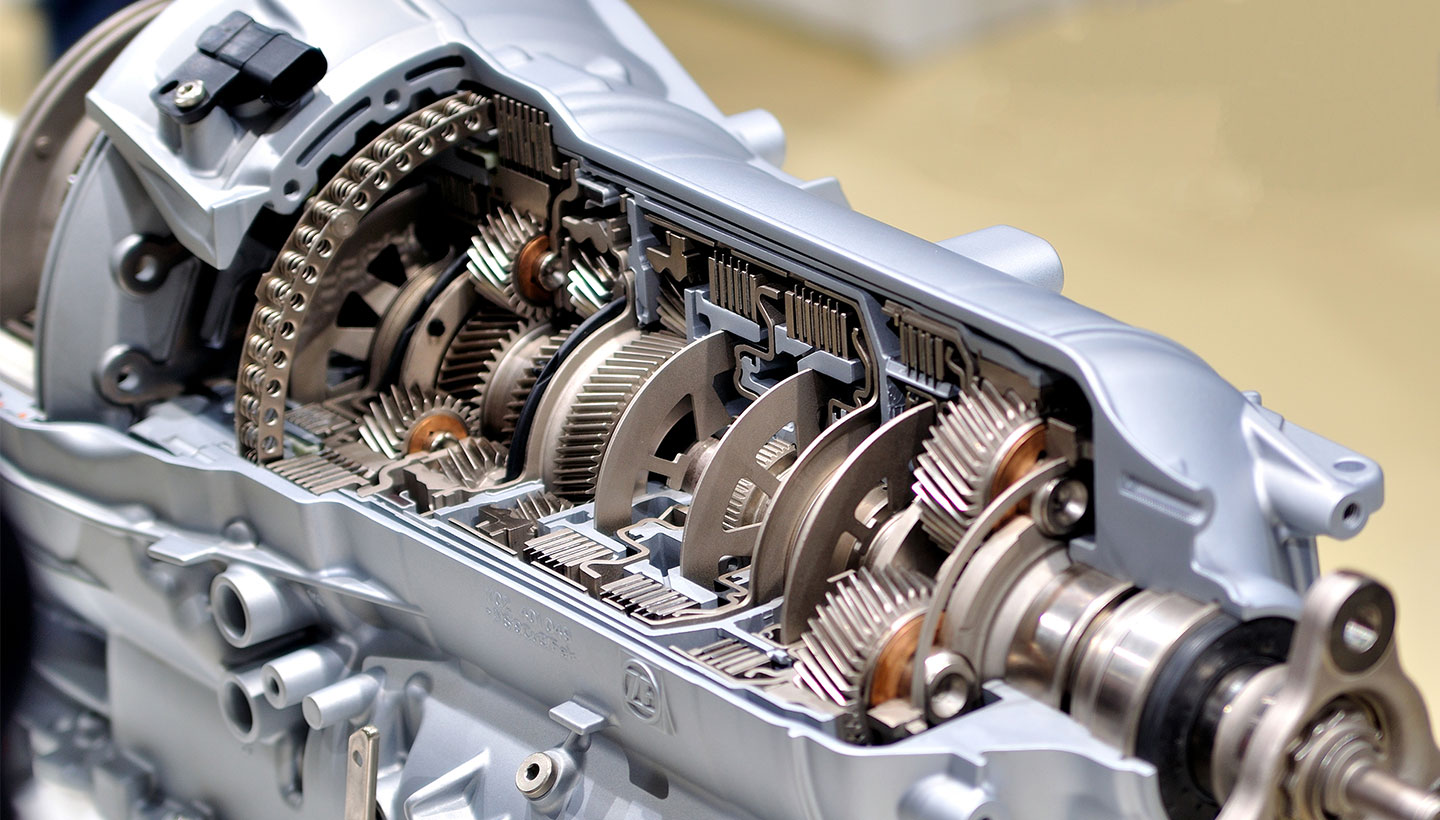

Steel precision casting is a sophisticated manufacturing process enabling the creation of high-accuracy, complex-shaped components. This process, also known as investment casting, leverages wax patterns and refractory materials to achieve superior surface finishes and dimensional tolerances (up to ±0.05 mm). Applications span aerospace turbine blades, medical implants, and critical automotive engine components, where accuracy is vital.

The global market for precision casting parts in steel is projected to surpass $115 billion by 2028 (Statista, 2023), driven by automotive electrification and infrastructure growth. The method supports customization, crucial for prototyping and low- to mid-volume production runs. By minimizing wasted material and enabling the use of advanced alloys, precision casting parts significantly reduce total production costs while increasing component longevity.

Key Technical Advantages in Today’s Steel Trading Industry

Technical advancements have redefined how steel is traded and utilized. Digital supply chain tracking, quality assurance protocols, and innovations in material composition have collectively improved efficiency and transparency. Modern steel trading platforms—infused with AI-driven analytics—predict price trends with accuracy rates exceeding 92%, giving stakeholders a competitive edge.

In parallel, steel investment casting companies are rapidly adopting automated process control, reducing defects to less than 1% and improving yield rates by up to 15%. Deploying Corrosion-Resistant Alloys (CRA), they cater to industries requiring high durability and minimal maintenance. Control over wall thickness (as low as 2 mm) and high repeatability ensures standards necessary for mission-critical and safety-related components.

Key Technical Data:

- Surface finish: Max Ra 1.6 μm

- Yield rate improvement: Up to 15%

- Defect rate: <1%

- Wall thickness: From 2 mm

- Rapid prototyping lead time: 2-4 weeks

Comparing Leading Stainless Steel Investment Casting Companies

Selecting an optimal supplier is crucial for manufacturing success. The following table compares several globally recognized stainless steel investment casting companies based on production capacity, lead times, certification, and areas of expertise.

| Company | Annual Output (tons) | Lead Time (weeks) | Certifications | Specialization |

|---|---|---|---|---|

| PrecisionCast Ltd. | 18,000 | 3–5 | ISO 9001, IATF 16949 | Automotive, Marine Applications |

| SteelForm Technologies | 22,500 | 2–4 | ISO 9001, AS9100 | Aerospace, Toolmaking |

| Alloy Innovators | 14,800 | 4–6 | ISO 13485, ISO 14001 | Medical, Industrial Equipment |

| ProCast Stainless | 19,900 | 3–5 | ISO 9001 | Energy, Construction |

Evaluating these leading casting companies highlights major distinctions in output agility and technical certifications, directly impacting final product quality and project timelines. Clients seeking medical or aerospace components may prioritize strict certification, while others focus on lead time or cost.

Customized Solutions: Meeting Diverse Industry Needs

Unique specifications drive innovation across steel trading and manufacturing. Custom steel precision casting parts respond to sector-specific challenges—be it ultra-thin wall sections for electronics or corrosion-proof assemblies for offshore drilling. Integrating advanced simulation software during the design phase minimizes risks and optimizes both flow and solidification, resulting in higher reliability.

The process often involves coordinated engineering feedback, rapid prototyping, and stringent non-destructive testing (NDT) procedures. According to recent surveys, 87% of industrial clients now prefer customized casting solutions over standard parts, citing top drivers as reduced lifecycle costs and improved fit-to-function ratios.

As regulatory standards tighten—especially concerning environmental impact—manufacturers increasingly require materials that comply with REACH, RoHS, and require comprehensive documentation for traceability. Tailored alloys, finishing processes (such as passivation or hydrogen embrittlement relief), and post-casting CNC machining round out the suite of fully custom offerings available to modern clients.

Application Cases: Real-World Success Stories and Data Insights

The following case studies and data highlight how effective steel trading and investment casting translate into measurable operational gains:

- Automotive Drivetrain Manufacturer: By shifting to an optimized supplier of steel precision casting parts, the company reduced its reject rate from 2.5% to 0.6% and cut total component costs by 13% over 12 months.

- Renewable Energy Firm: Implementing advanced corrosion-resistant investment cast parts in wind turbines resulted in service interval extension by 22%, saving $2.6 million annually.

- Medical Device Producer: Utilizing stainless steel investment casting companies allowed for seamless production of minimally invasive surgical tool assemblies, meeting FDA clean manufacturing standards and improving component mechanical strength by 17%.

These successes confirm that strategic supplier selection and technological advancements in casting generate downstream economic and operational value, creating robust, long-lasting relationships across the supply chain.

Future Trends in Steel Trading: Challenges and Opportunities

As steel trading continues to evolve, the industry encounters a mix of daunting challenges and promising opportunities. Ongoing supply chain disruptions, increasing material costs, and a push towards decarbonization are reshaping supplier dynamics and operational requirements. Emerging markets are projected to account for over 60% of new steel demand by 2030, underlining a transformative shift in global supply and demand.

The advance of automation, digital quality control, and “green” steel initiatives presents significant potential for cost reduction and value creation. As regulatory regimes tighten, transparency and traceability become non-negotiable. Investment in digital platforms and sustainable sourcing is expected to propel leading players ahead of the curve, providing an essential foundation for future growth. In conclusion, steel trading remains pivotal, continuously integrating innovative approaches and adapting to changing market conditions—ensuring ongoing relevance in a rapidly transforming manufacturing landscape.

(steel trading)

FAQS on steel trading

Q: What is steel trading?

A: Steel trading refers to the buying, selling, and distribution of steel products between manufacturers, suppliers, and end users. It involves various steel types and grades for different industrial applications. This process is essential for efficient supply chain management in the steel industry.Q: What are steel precision casting parts?

A: Steel precision casting parts are high-accuracy steel components created using lost wax or investment casting techniques. These parts offer excellent detail and surface finish. They are widely used in industries requiring intricate and reliable steel components.Q: Why should I choose stainless steel investment casting companies?

A: Stainless steel investment casting companies specialize in producing complex, high-quality components with corrosion resistance. They provide customizable solutions for various industrial applications. Choosing these companies ensures consistency and durability in your steel parts.Q: How do steel trading companies ensure the quality of their products?

A: Steel trading companies partner with certified manufacturers and conduct rigorous quality inspections. They follow industry standards and often provide documentation for traceability. This ensures customers receive reliable and high-standard steel products.Q: What industries benefit most from stainless steel investment casting parts?

A: Industries like automotive, aerospace, medical, and food processing greatly benefit from stainless steel investment casting parts. These sectors require parts with strength, precision, and corrosion resistance. As a result, stainless steel castings are a preferred choice for critical applications.-

Premium Fan Housing & Motor Casing for Optimal AirflowNewsAug.31,2025

-

High-Performance Automobile Water Pump & Electric SolutionsNewsAug.30,2025

-

Expert Stainless Steel Casting | Precision & Durable Metal PartsNewsAug.29,2025

-

Precision Metal Castings: Aluminum, Stainless Steel & Die CastingNewsAug.28,2025

-

Superior Aluminum Castings in Automotive Engine PartsNewsAug.22,2025

-

Common Materials Used in Fan Housing ManufacturingNewsAug.22,2025