Mobile:+86-311-808-126-83

Email:info@ydcastings.com

Exploring the Impact of 4% End Cap on Investment Strategies and Asset Management

Exploring the Impact of the 4% End Cap Rule on Retirement Planning

Retirement planning is a crucial aspect of financial management that can significantly affect individuals' quality of life in their senior years. One popular guideline that has emerged in recent discussions around retirement savings is the 4% rule, a strategy aimed at helping retirees withdraw funds from their savings in a sustainable manner. This article explores the concept of the 4% end cap and its implications for those planning their retirement.

Exploring the Impact of the 4% End Cap Rule on Retirement Planning

The importance of the 4% end cap lies in its ability to provide structured guidance on how much a retiree can safely withdraw without depleting their resources too quickly. For example, if someone has a retirement portfolio worth $1 million, they could withdraw $40,000 in the first year, and then increase that amount each subsequent year to keep pace with inflation. This strategy helps ensure retirees have a reliable source of income while preserving their capital for potential market downturns.

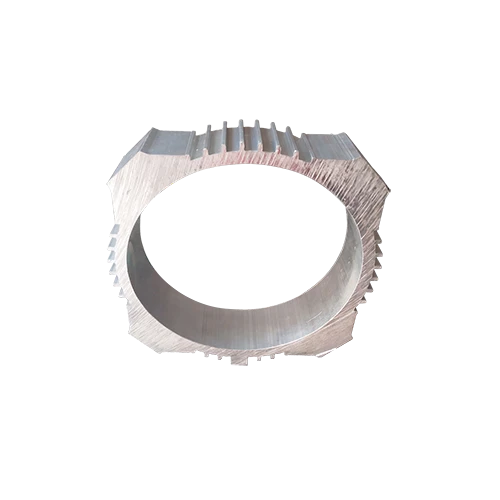

4 end cap

However, it is essential to understand that the 4% rule is not universally applicable. Factors such as individual spending needs, investment choices, market conditions, and life expectancy must be considered. For instance, if retirees have a lower risk tolerance or prefer a more conservative investment strategy, a withdrawal rate lower than 4% may be more prudent. Conversely, those who are willing to accept more risk might aim for higher returns and could potentially withdraw a bit more, but this comes with the inherent risk of exhausting their funds.

Furthermore, the 4% rule assumes a balanced portfolio of stocks and bonds, typically favoring a more aggressive allocation in the early years of retirement. As retirees age, they may want to shift towards more conservative investments to reduce volatility, which could affect withdrawal rates. In a prolonged low-interest rate environment or during significant market corrections, the assumption that a portfolio can sustain a 4% withdrawal may not hold true, necessitating reevaluation of one's financial strategy.

In conclusion, the 4% end cap serves as a practical foundation for retirement planning, offering a guideline that balances the need for sufficient income with the desire to preserve capital. It emphasizes the importance of tailored planning, recognizing that each individual's circumstances differ. While the 4% rule can provide direction, retirees must also remain flexible and regularly assess their financial situation to ensure a secure and comfortable retirement. Therefore, consulting with a financial advisor can be invaluable in navigating this complex landscape and optimizing one's retirement strategy.