Mobile:+86-311-808-126-83

Email:info@ydcastings.com

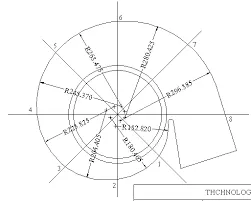

2 end cap

The Significance of a 2% End Cap in Financial Management

In the realm of financial management and investment strategies, the concept of a 2% end cap holds particular significance, especially as it pertains to risk management and profit maximization. The term end cap refers to a limit or cap placed on certain financial metrics, with 2% commonly representing a threshold for expectations in various contexts. This article will explore the implications and applications of a 2% end cap, particularly within the realms of savings, investment, and market stability.

The Significance of a 2% End Cap in Financial Management

In the investment world, a 2% cap can also denote a target return on investment (ROI) for various portfolios. Investors often look for instruments that promise, at a minimum, a 2% return. This cap serves as a benchmark that helps investors gauge the performance of their investments relative to market averages. Additionally, a consistent 2% return might not seem substantial, but it can compound significantly over time, becoming a critical part of long-term financial planning. This principle underscores the necessity of balancing risk and return — whereas higher returns may be available, they often come with increased levels of risk.

2 end cap

Moreover, in the context of real estate investment, a 2% cap rate (which reflects the ratio of a property's net operating income to its purchase price) can be indicative of market maturity. Properties yielding a cap rate of around 2% suggest that the market is saturated, making it essential for investors to conduct thorough due diligence to ensure their investments are sound. Investors often use this metric to compare different properties, assess potential returns, and make informed decisions about acquisitions or divestitures.

The 2% end cap also plays a critical role in the behavior and strategies of financial institutions. Banks and other lending entities often utilize this figure as a guideline for setting interest rates on loans and savings accounts. A lower end cap may encourage borrowing and spending, while a higher one may promote saving. Understanding this dynamic is essential for consumers and businesses alike when planning their financial futures.

In conclusion, the 2% end cap serves as a vital tool in the fluid landscape of finance and investment. By establishing a benchmark for returns, inflation, and market behavior, it provides a frame of reference for individuals and institutions. Whether it pertains to personal savings, investment portfolios, or broader economic policies, the implications of maintaining a 2% threshold resonate throughout the financial ecosystem. As we navigate through increasingly complex financial environments, the significance of the 2% end cap continues to highlight the interplay between risk and reward, ultimately guiding smarter, more informed decision-making processes in the pursuit of financial growth and stability.

-

Impeller Technology That Powers Precision in Pump SystemsNewsMay.22,2025

-

Valve Durability Begins with Quality Cast Iron ComponentsNewsMay.22,2025

-

Performance Cooling with Advanced Automobile Water Pump SolutionsNewsMay.22,2025

-

How Motor Housing and Oil Pans Shape Engine PerformanceNewsMay.22,2025

-

How Metal Castings Drive Modern Manufacturing EfficiencyNewsMay.22,2025

-

Exploring the Engineering Behind Valve Body CastingsNewsMay.22,2025