Mobile:+86-311-808-126-83

Email:info@ydcastings.com

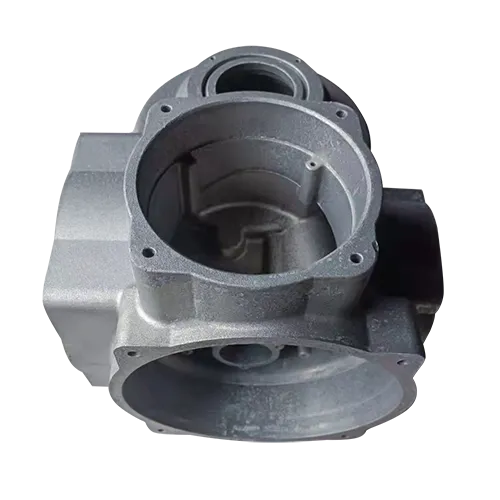

1.5 end cap

Understanding the 1.5% 20 End Cap A Strategy for Success

In today's rapidly evolving financial landscape, investment strategies that emphasize transparency and performance are becoming increasingly popular among investors. One such strategy that has gained traction in recent years is the 1.5% 20 end cap structure. This approach not only aligns the interests of fund managers with those of their investors but also provides a straightforward method for assessing fees and performance expectations.

What is the 1.5% 20 End Cap?

The term “1.5% 20 end cap” refers to a fee structure commonly used in private equity and hedge funds. The 1.5% typically denotes the management fee, which is charged annually based on the total assets under management (AUM). This fee is paid regardless of the fund's performance, allowing fund managers to cover operating expenses and maintain their teams.

The 20 represents the performance fee, often referred to as the carry or carried interest. This fee is typically charged only after the fund has generated returns above a predetermined benchmark or hurdle rate. The 20% figure means that the fund manager takes 20% of the profits generated beyond this hurdle, aligning their compensation with the fund's performance.

The addition of an “end cap” refers to a cap on the total fees or growth of fees over time. This cap is an important feature that protects investors from escalating costs, ensuring that they do not pay excessively if the fund performs well.

Benefits of the 1

.5% 20 End Cap Structure1. Alignment of Interests One of the primary advantages of this fee structure is the alignment it promotes between fund managers and investors. Since a significant portion of the manager's compensation is tied to performance, they are incentivized to maximize returns for their investors.

2. Transparency Investors appreciate a fee structure that is straightforward and easy to understand. The 1.5% management fee and the 20% performance fee provide clarity regarding what investors are paying and how fees correlate with returns.

1.5 end cap

3. Controlled Costs With the introduction of the end cap, investors can have peace of mind regarding the upper limits of their costs. This feature prevents excessive fees from accumulating, which can happen in other structures where performance fees are uncapped.

4. Encourages Long-Term Thinking The performance fee component encourages fund managers to take a long-term view when making investment decisions. Since they only receive a portion of the profits once a certain level of returns is achieved, they are less likely to focus on short-term gains at the expense of sustainable growth.

Considerations for Investors

While the 1.5% 20 end cap structure offers numerous benefits, investors should still perform due diligence before committing their capital. Here are a few factors to consider

1. Benchmark Understanding Investors should have a clear understanding of the benchmarks used to determine performance fees. Different benchmarks can lead to different outcomes, affecting how and when performance fees are charged.

2. Potential Soft Costs It is essential for investors to be aware of any additional soft costs associated with investing in a fund, as these may not be included in the stated fee structure.

3. Fund Manager Track Record The success of any investment fund ultimately depends on the capability of the fund manager. Researching their track record and investment philosophy can provide insights into their potential for achieving promised returns.

Conclusion

The 1.5% 20 end cap structure is a compelling investment strategy that harmonizes the interests of fund managers and investors, offering a transparent and performance-driven approach to fees. As financial markets continue to evolve, understanding and embracing innovative fee structures like this can enhance the investment experience, ensuring that both parties are rewarded fairly for their efforts and risks. With careful consideration and due diligence, investors can leverage this strategy to achieve their financial goals.

-

Impeller Technology That Powers Precision in Pump SystemsNewsMay.22,2025

-

Valve Durability Begins with Quality Cast Iron ComponentsNewsMay.22,2025

-

Performance Cooling with Advanced Automobile Water Pump SolutionsNewsMay.22,2025

-

How Motor Housing and Oil Pans Shape Engine PerformanceNewsMay.22,2025

-

How Metal Castings Drive Modern Manufacturing EfficiencyNewsMay.22,2025

-

Exploring the Engineering Behind Valve Body CastingsNewsMay.22,2025