Mobile:+86-311-808-126-83

Email:info@ydcastings.com

Global Metal Casting Market Size and Trends

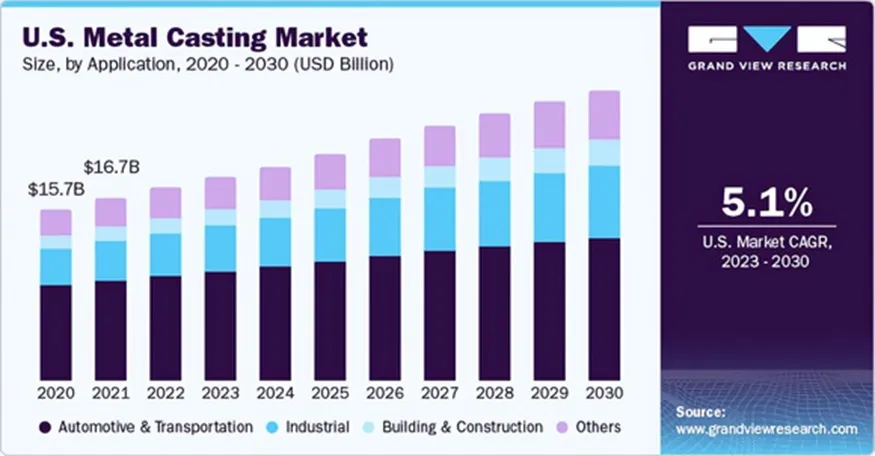

The global metal casting market size was USD 136.71 billion in 2022 and is expected to grow at a CAGR of 5.5% from 2023 to 2030. Increasing demand for castings in the automotive industry is expected to drive the market growth during the forecast period.

Metal casting is a popular manufacturing process that involves pouring metal into a mold or sand pattern to obtain the desired shape. It helps in producing complex and large-sized parts for various industrial applications. Stringent regulations regarding pollution and energy efficiency requirements for vehicles are driving the growth of the metal casting industry. The regulations are forcing automakers to shift to lighter vehicles to improve fuel efficiency.

Increasing use of castings due to their lightweight properties and aesthetic appeal is driving the demand for aluminum castings in the construction market. Finished products are used in construction equipment and machinery, heavy vehicles, curtain walls, door handles, windows, and roofing. The ability to recycle aluminum products is becoming a key factor as building owners increasingly move toward structuring rather than demolishing old or abandoned buildings. Deriving recyclable materials from buildings also reduces the environmental impact of construction activities.

Cast iron is an alloy containing metals such as silicon, carbon, manganese, sulfur, and phosphorus and has a wide range of applications. Increasing demand for pots, pans, utensils, engines, pipes, and automobiles are the growth factors for the cast iron market. The demand for gray iron metal is expected to increase in the coming years due to its application in housings, engine blocks, cylinder heads, and casings. Its properties such as stiffness, high thermal conductivity, and wear resistance make it useful in such applications.

The global market is expected to be driven by growing demand for the product from end-use industries, especially in Asia Pacific, during the forecast period. The use of aluminum and stainless steel casting products in the healthcare and telecommunication industries is likely to have a positive impact on the market growth. Growing demand from the construction industry in Asia is one of the major growth drivers for this market.

The construction industry in Asia Pacific is mainly driven by developing countries in the region, including China, India, Malaysia, Indonesia, and others. For instance, in 2018, the residential and non-residential sector in Malaysia grew at a real growth rate of nearly 4.4%. Similarly, Indonesia's construction sector achieved a healthy growth of around 7-8%. in 2018, construction projects in the country totaled USD 32.2 billion, excluding the oil and gas sector.

The growth of the construction industry in the aforementioned countries is largely attributed to the ongoing support programs provided by the government. For example, to encourage first-time homebuyers, Indonesia's central bank eliminated its 15% minimum mortgage down payment program and relaxed loan origination regulations. As a result of these government incentives, the construction industry in the Asia-Pacific region is likely to witness steady growth. Thereby, driving the demand for cast metal products during the forecast period.

In addition, increasing penetration of aluminum as an efficient and lightweight material in automotive production is further driving the market growth. The Corporate Average Fuel Economy (CAFE) average fuel efficiency targets have doubled from 2012 to 2025 due to increasing greenhouse gas emissions. To meet the regulatory requirements, vehicle weight reduction through the use of aluminum will play a key role in these conditions.

Technological developments in the automotive sector are driving demand for automotive products. China is the world's largest automotive market in terms of demand and supply. South Korea, Japan, and India are among the top 10 automotive markets, which is creating a huge demand for aluminum in the Asia-Pacific region. Growing demand for automobiles in the U.S. is also expected to drive the demand for aluminum castings during the forecast period. The average aluminum content of light vehicles has increased by more than 4% from 2017 to 2018.

The metal casting industry requires large machine tools and other heavy equipment for production. The industry also has a huge demand for space. For these reasons, it is known to be capital intensive. In addition, skilled labor is required to handle the products during transportation, which increases the overall cost of metal casting products. Continuous technological advancement in manufacturing high quality products also requires substantial investment in research and development. The requirement of skilled professionals to operate advanced machinery is another restraint in the market, especially in developing countries and less developed economies.

Material Insights

Aluminum segment held the largest revenue share of 38.3% in 2022. Major demand from this segment is expected to come from emerging markets, especially from automotive, construction, and oil & gas industries. Finished castings are likely to remain a key area of focus for investors. According to the World Foundry Organization, the production of cast iron parts increased by 0.8% in 2017 as compared to the previous year. 156.58 kilotons in 2017. Compared to 2016, the production of ductile iron and gray iron metal products increased by 1.1% and 1.3%, respectively, in 2017.

Revenue from the aluminum segment is expected to grow at a CAGR of 8.7% during the forecast period. Demand for lightweight metals including magnesium and aluminum is expected to create many opportunities for market vendors. Stricter emission regulations and increasing energy efficiency requirements are expected to boost the production of lightweight materials in the market during the forecast period. These materials help in reducing fuel consumption due to the light weight of automotive components.

The industrial sector is expected to grow at the fastest CAGR of 5.9% during the forecast period. Industrial products such as decanters, metal valves and gaskets, flanges, air injection tubes, coal blowing tubes, air injection pipes, collectors, radiation protection tubes, drums, elbows, and bends are manufactured using steel materials. Expansion of manufacturing sector in China and other emerging countries is expected to drive the growth of the industrial sector.

The construction industry is one of the major consumers of different types of cast products. Increasing focus on infrastructure and investments is driving the growth of the sector. Governments of different countries are investing in various infrastructure projects including transportation, water supply, telecommunication, and energy networks.

Regional Insights

Asia Pacific dominated the market with the largest revenue share of 55.4% by 2022. Asia-Pacific is characterized by the availability of low-cost skilled labor, which makes it the most lucrative region for manufacturers to set up production facilities. The shift in the global production landscape towards emerging economies, especially China and India, is expected to positively impact market growth over the forecast period. Rapidly expanding automotive industry in the region is expected to further drive the market growth over the forecast period.

-

Why Should You Invest in Superior Pump Castings for Your Equipment?NewsJun.09,2025

-

Unlock Performance Potential with Stainless Impellers and Aluminum End CapsNewsJun.09,2025

-

Revolutionize Your Machinery with Superior Cast Iron and Aluminum ComponentsNewsJun.09,2025

-

Revolutionize Fluid Dynamics with Premium Pump ComponentsNewsJun.09,2025

-

Optimizing Industrial Systems with Essential Valve ComponentsNewsJun.09,2025

-

Elevate Grid Efficiency with High-Precision Power CastingsNewsJun.09,2025