Mobile:+86-311-808-126-83

Email:info@ydcastings.com

English

Exploring the Innovative Features and Benefits of ABS End Cap Technology for Enhanced Performance

Understanding ABS End Cap in Financial Markets

Asset-backed securities (ABS) have become an essential component of the financial markets, enabling organizations to transform illiquid assets into liquid securities. Among the various terminologies and concepts associated with ABS, the term end cap stands out because of its implications for risk management and investment strategies.

What is ABS?

Asset-backed securities are financial instruments backed by a pool of assets, usually comprising loans, leases, credit card debt, or other receivables. Investors purchase these securities in the hopes of receiving regular payments derived from the cash flows generated by the underlying assets. The appeal of ABS lies in their ability to enhance market liquidity and pool different types of credit risk.

The Concept of End Cap

When discussing ABS, the term end cap often relates to the features and limitations placed on the securities to protect investors and stabilize the market. An end cap can refer to a ceiling on the payout or yield that investors can expect from their ABS investments. By establishing an upper limit on potential returns, end caps play a crucial role in managing risk.

End caps can serve various purposes, including

1. Risk Mitigation By setting a maximum return, end caps can help to mitigate risks associated with the underlying assets. This can be particularly crucial in volatile markets or economic downturns where asset performance may be unpredictable.

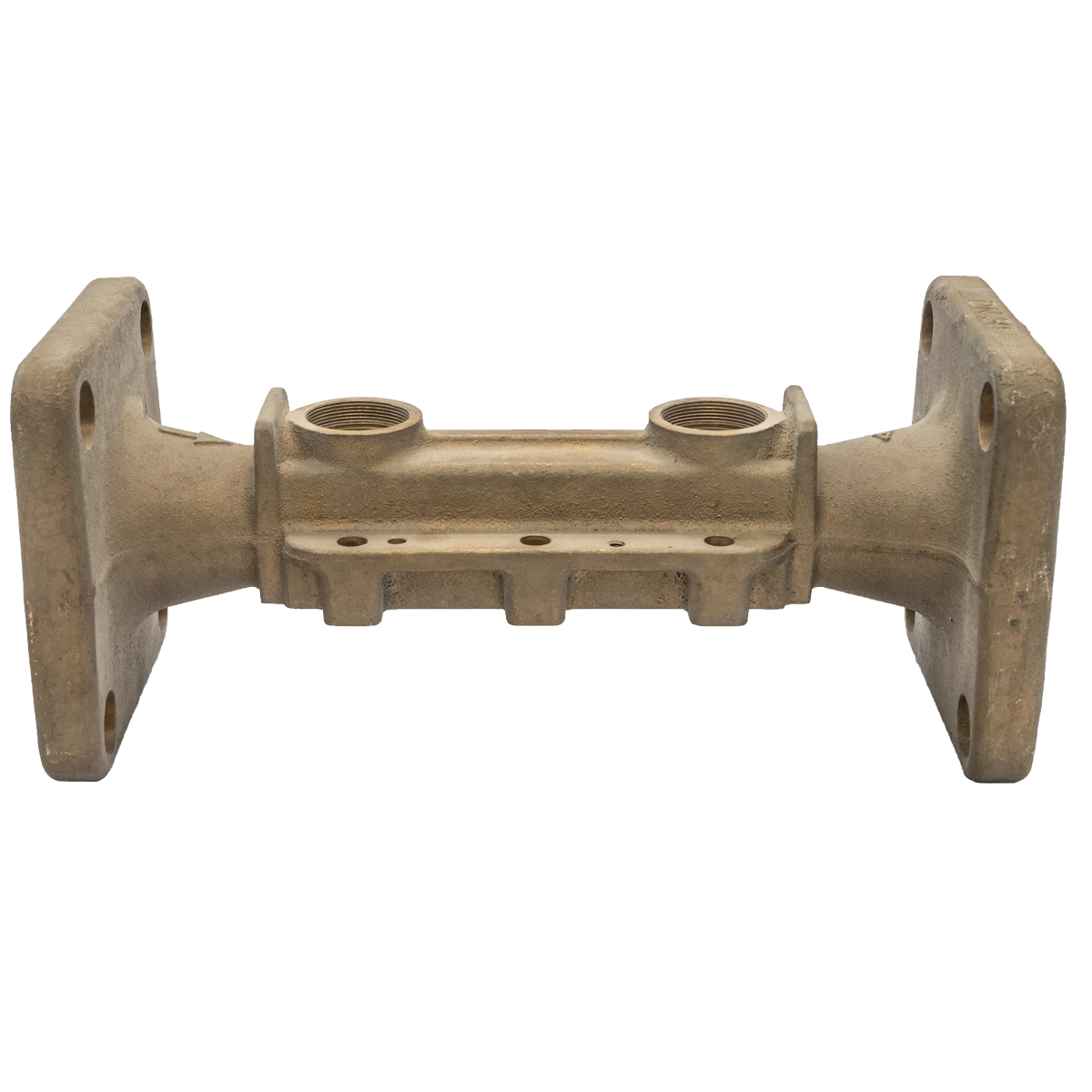

abs end cap

2. Investor Protection End caps can protect investors from excessive losses that might occur if asset performance deteriorates beyond expected thresholds. This feature can attract more conservative investors who are looking for stable returns without high levels of risk.

3. Market Stability By limiting excessive payouts that could lead to unsustainable market behavior, end caps contribute to the overall stability of the financial system. They encourage responsible investment practices and deter speculative behaviors that might lead to market bubbles.

Impact on Investment Strategies

For investors, understanding the implications of end caps is crucial in shaping their investment strategies. While end caps can limit maximum returns, they often come with the trade-off of improving the overall risk profile of the investment. This means that investors must carefully analyze their risk tolerance and investment objectives when considering ABS with end caps.

Investors might tailor their portfolios by incorporating a mix of ABS that includes those with end caps alongside those without. This strategy allows for a balance between potential high returns and risk management. Furthermore, understanding end caps can give investors an edge in evaluating the attractiveness of specific ABS offerings compared to other investment vehicles.

Conclusion

The concept of ABS end caps encapsulates essential considerations for both issuers and investors in the asset-backed securities market. By mitigating risks and fostering market stability, end caps play a vital role in the broader context of financial management and investment strategies. As financial markets continue to evolve, understanding these nuances will be critical for participants aiming to optimize their investment outcomes while managing inherent risks. For investors seeking predictable cash flows with controlled exposures, exploring ABS with end caps could provide a viable pathway to achieving their financial goals.

-

Materials Used in Manufacturing Cap End Pipe FittingsNewsNov.24,2025

-

Material Properties of CF8M CastingNewsNov.24,2025

-

How to Inspect Pump Cap Ends for DamageNewsNov.21,2025

-

Backward Curved Impeller – Efficient Airflow Solutions for Industry | YD CastingsNewsNov.21,2025

-

Automobile Water Pump - Efficient, Quiet, Durable & ElectricNewsNov.21,2025

-

Impeller for Pumps – High-Efficiency, Durable, OEM-ReadyNewsNov.21,2025