Mobile:+86-311-808-126-83

Email:info@ydcastings.com

English

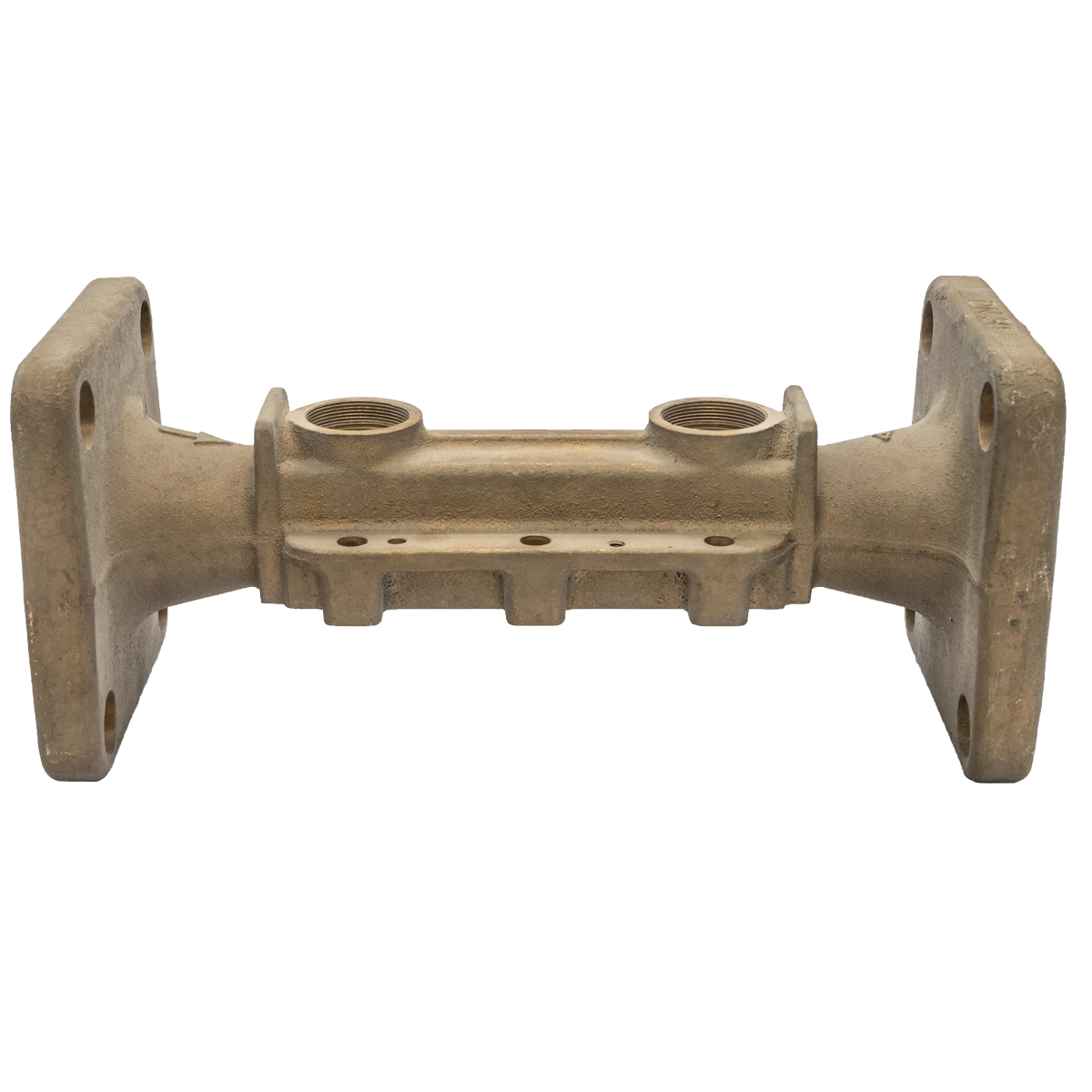

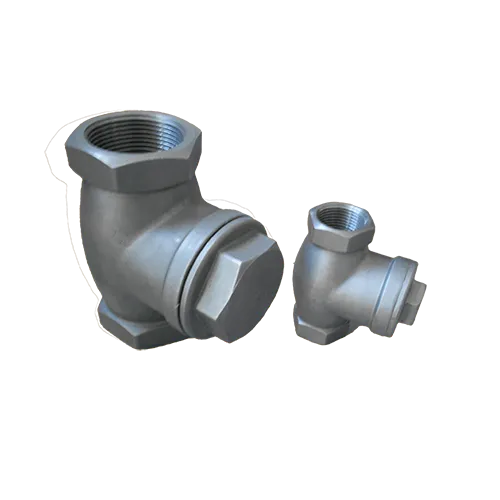

1 2 end cap

The Impact of 1% and 2% End Caps in Investment Strategies

In the ever-evolving world of investment, the terms “1% end cap” and “2% end cap” are becoming increasingly significant. These terms refer to the maximum fee limits that investors may encounter when engaging with certain financial products, particularly in the realm of fund management. With the growing scrutiny on fees and the impact they have on investment returns, understanding end caps is essential for both casual investors and financial professionals alike.

The Impact of 1% and 2% End Caps in Investment Strategies

One of the main benefits of implementing end caps is the protection they offer to investors. High fees can significantly erode investment returns over time, a fact that has been well-documented in financial literature. By imposing an end cap, investors gain a sense of security, knowing that their maximum fees will not exceed a predetermined limit. This can be particularly appealing in volatile markets, where investment returns can fluctuate dramatically. Having a clear understanding of fee structures allows investors to make more informed decisions, enabling them to allocate their resources more effectively.

1 2 end cap

Furthermore, end caps promote transparency within the investment industry. When investment firms establish clear limitations on their fees, they are incentivized to communicate these costs upfront. This transparency can mitigate potential conflicts of interest and foster a trust-based relationship between investors and fund managers. In an era where financial literacy is increasingly emphasized, having access to straightforward fee structures is essential for empowering investors to take charge of their financial futures.

However, while end caps protect investors from exorbitant fees, they also raise questions about the long-term sustainability of fund management companies. If the cap is set too low, there may be insufficient revenue for fund managers to maintain the quality of their services, invest in research, or adapt to changing market conditions. As a result, it is crucial for investors to strike a balance between seeking out competitive fee structures and ensuring that the fund they choose can deliver value through expertise, performance, and adequate resources.

In addition, understanding the implications of 1% and 2% end caps can influence investment strategies. Investors looking to maximize their returns may choose funds with lower fees to enhance their net gains over time. For instance, even a seemingly modest difference in fees, such as 1% versus 2%, can lead to a substantial difference in investment growth over the long haul due to the compounding effect. Recognizing this dynamic is essential for investors aiming to build and preserve wealth.

In conclusion, the concepts of 1% and 2% end caps are integral to navigating the investment landscape. They offer a framework for understanding fees, promoting transparency, and protecting investors. As the financial world becomes more complex, investors must remain vigilant and informed about the costs associated with their investments. Adopting a keen awareness of fee structures allows investors not only to safeguard their assets but also to make rational decisions that enhance their potential for financial success. With the right knowledge and strategies, investors can confidently move towards achieving their financial goals.

-

Materials Used in Manufacturing Cap End Pipe FittingsNewsNov.24,2025

-

Material Properties of CF8M CastingNewsNov.24,2025

-

How to Inspect Pump Cap Ends for DamageNewsNov.21,2025

-

Backward Curved Impeller – Efficient Airflow Solutions for Industry | YD CastingsNewsNov.21,2025

-

Automobile Water Pump - Efficient, Quiet, Durable & ElectricNewsNov.21,2025

-

Impeller for Pumps – High-Efficiency, Durable, OEM-ReadyNewsNov.21,2025